How I learned to anticipate the future by studying the past

1971 The US ran out of money, how? gold was used as a means of transaction in several countries. The US provides more paper money than available gold, so people hunt to exchange paper money in anticipation of running out of gold. 15 august president Nixont went to tell the world that The US is breaking its promise to let people exchange their dollars for gold he said in a diplomatic way. When the central banks print a lot of money, buy stocks, gold, and commodities, then the exchange rate for gold continues to rise. This has happened many times before (The US, UK, Dutch netherland). And this also happened in 2008 during the mortgage driven debt crisis and 2020 during the pandemic, and could still happen in the future.

- Countries didn’t have enough money to pay debts

- Big internal conflicts emerged due to growing gaps in wealth and values

- Increasing external conflict between a rising great power and the leading great power china US

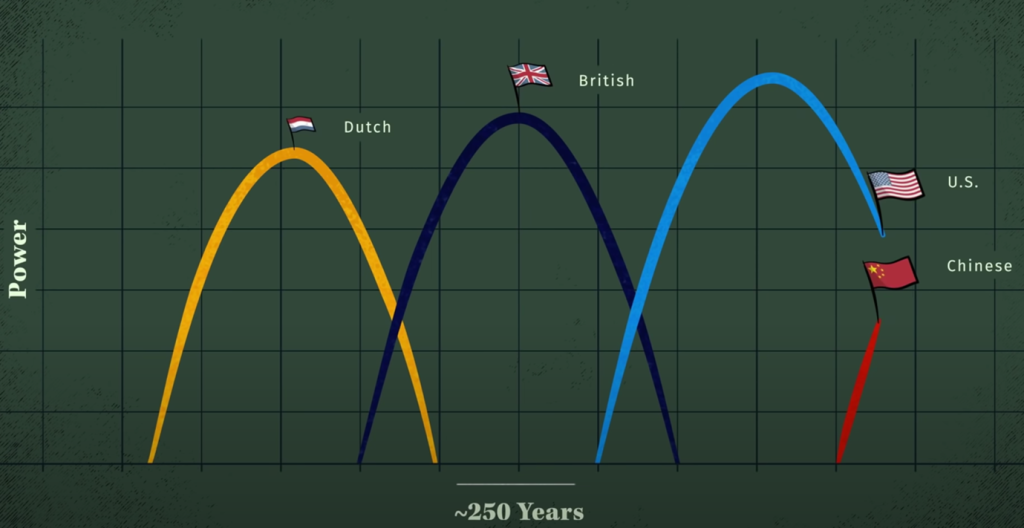

The Big Cycle

The fourth great empires included the Dutch, British, US and Chinese. An instrument to measure how strong they are in the present, the past and whether they are improving or declining. The 8 strengths: education, innovation and technology, competitiveness, output, trade, military, financial center and reserve status. Five hundred years of big cycles divided into 3 parts:

- The Rise

New World Order, Successful new orders both internal and external started by powerful revolutionary leaders doing four things. First win power, consolidate power, establish systems and institutions, four pick a successor because a great empire requires many great leaders.

Peace, prosperity, and productivity because the leadership is clearly dominant and has broad support so no one wants to fight. At this time, leaders usually create an excellent system to increase the power and wealth of the country, namely by strengthening education, by having a good education system, character will be good and also reduce the value of corruption. After this they increasingly shift from producing basic products and they are innovating and inventing new technology. For example Dutch innovating telescope 1624, pendulum clock 1657, dutch windmill 1670, and the most important was the invention of ships, Dutch Fluyt 1677. “The best thinking in the world” then the people of the country become more productive so that they have high competitiveness in the world market and have more output (growing economic output) and increase their share of world trade. As a country that carries out global trade, of course they have to protect their area by providing military power. If this cycle runs smoothly, it will encourage strengthening income growth which can be used for financial investment in infrastructure education or research and development. As successful empires, they use capitalism to develop the productivity of business people.

Financial bubble, having a reserve currency enabled the empire to borrow more than another country’s large profits from various countries. And when the empire runs out of its own money they can always print more. The exorbitant privilege afforded by the empire’s reserved currency leads borrowing to increase and the beginning of a financial bubble.

- The Top

People in rich and powerful countries have higher incomes compared to other countries with lower wages. Other countries imitate the methods and technology of developed countries by offering lower output prices because their workers’ wages are lower than those of developed countries. This reduces the competitiveness of developed countries. During this period, rich people become less productive and more concerned with pleasure alone, making them vulnerable to challenges. A gap is created in values, politics, and opportunities for growth between the rich and the poor have not, so resentment grows. Having a world reserve currency causes excessive borrowing and the accumulation of debt in countries that provide loans. Even though in the short term it increases purchasing power, in the long term it weakens the currency. If the empire begins to run out of new lenders, those holding their currency begin to look to sell and get out rather than save loans and get in and the strength of the empire begins to decline. When a rich country tries to expand its territory, government spending is greater than its own income. Rich countries that continue to try to expand their territory are starting to get into debt and are starting to borrow from poor countries, this is an early sign of a shift in power and wealth.

- The Decline

Internal economic weakness together in internal fighting or costly external fighting or both. When the debts are large, economic downturn and the empire can no longer borrow money to repay debts the financial bubbles burst. The government prints a lot of money necessary to repay the debts. but when There is a lot of money circulating in society it causes a lot of increase and inflation is inevitable. It also happened to the Dutch after defeat in the fourth Anglo Dutch war and the British after world war II. When they print a lot of money to repay the debts. When the Government has problems funding itself and there’s bad economic condition also there are large wealth, values, political gaps and internal conflict greatly increases. At this time, rich people were burdened with high taxes, which made rich people move to new places as well as their assets and currency to safer places. then government tax revenues decrease. a civil war occured to redistribute wealth and force the necessary big changes. After the war there were winners and began to restructure the losers debts and political systems and established the new world order. then the old cycle and empire ends and the new begins and they do it all over again.

The Principle of Powers

Ray proposes a framework for assessing the relative strengths of these countries. The criteria for evaluation are as follows:

- Leadership Capabilities: The ability of the nation’s leadership to make wise decisions and to avoid succumbing to the allure of taking the “easy path” while making the necessary difficult decisions.

- Education Levels: The emphasis placed by the nation’s leadership and people on investing in education.

- Character / Determination of Population: This refers to the population’s tendency to work hard and treat each other with respect.

- Rule of Law: The development and enforcement of the rule of law, property rights, and civil liberties.

- Corruption: The extent of corruption within the nation. Lower levels of corruption lead to more favorable outcomes.

- Resource Allocation Efficiency: The nation’s ability to effectively organize and deploy its resources, including the development of its capital markets.

- Openness to Global Thinking: How effectively the nation can interact, influence, and be influenced by other nations.

Dalio contends that the United States and China are already engaged in seven types of conflict. He argues that history has shown us that there are five main types of conflict: trade/economic, technology, geopolitical, capital, and military. Dalio adds two more types: culture and internal conflict. He believes that these conflicts are interconnected and part of a larger, evolving conflict.

The Future

The United States is currently facing a significant financial crisis, with a record level of debt and a widening budget deficit. This deficit is being financed through increased borrowing and money printing, which could lead to a devaluation of the dollar and a decline in American economic power.

In recent decades, countries like China and India have experienced rapid economic growth and have become major players in the global economy. These countries, along with the other BRICS nations (Brazil, Russia, India, China, and South Africa), which represent over 40% of the world’s population and a quarter of global GDP, have formed an alliance to reduce their reliance on the US dollar as the global reserve currency. This movement towards de-dollarization poses a significant threat to the United States’ economic dominance.