Benjamin Graham is known as the father of Value Investing in his book entitled The Intelligent Investor. The Intelligent is a continuation of his book (with David L. Dodd) entitled Security Analysis whose language seems heavier & scientific. The extraordinary ideas from the Security Analysis book are rebranded and popularized with simpler language in The Intelligent Investor book.

This book offers a framework and logical approach to stock investment that aids in emotional control. The author’s investment philosophy stresses investor psychology, buy-and-hold investing, fundamental analysis, purchasing at safety margins, and a contrarian mindset. According to Warren Buffet, the most successful investor worldwide, this book by Benjamin Graham is unequivocally the best stock investment guide available. Not only that, but some investment experts, including Sir John Templeton, have hailed this book as the best investment guide of the past century.

Graham’s value investing strategy offers a dependable, low-risk method for safeguarding one’s investments and achieving satisfactory stock market returns. It substitutes hazardous conjecture on future stock prices with a methodical approach that reduces investment risk and fosters wealth creation. It is crucial to distinguish between investment and speculation.

Investment vs Speculations

Graham defines investment as a thorough analysis resulting in both safety of principal and an adequate return. According to Graham, intelligent investing requires three things: a careful analysis of a company and its business practices prior to purchasing any of its stock, safeguarding against significant losses, and striving for adequate performance rather than extraordinary outcomes.

Investors assess the fair value of a stock based on the business’s performance, whereas speculators are those who make bets on the price of a stock with the anticipation that someone else will be willing to purchase it at a higher price in the future. It is essential not to fixate on the movement of the market price unless it presents a chance to buy. Although intelligent speculation may seem counterintuitive, Graham stressed that it is possible, akin to intelligent investing. However, several circumstances can render speculation imprudent, such as: (1) mistaking speculation for investing; (2) speculating without sufficient artificial intelligence; (3) wagering beyond one’s risk tolerance. Investors should realize that they may be speculating without knowing it. According to Graham, some signs of this include:

- The Turnaround Trap, which involves buying stocks that are expected to increase profit in the near future,

- The Quality Trap, which involves blindly believing that past performance will repeat itself in the future.

- The Growth Trap (Long-term Selectivity): Over-optimism about a company that has not yet provided proof, but is said to be able to grow big in the future.

Mr. Market

Graham uses the allegory of Mr. Market to illustrate the ideal investor mentality regarding the stock market. Savvy investors will refrain from relying on Mr. Market to determine the accurate value of their stock holdings, but will acquire the product at a fair price and sell it at a higher price at a later date. Defensive investors who make value-based investments will ignore stock market valuations and only try to profit from its fluctuations. According to Graham, investors who pay too much attention to the current performance of the stock market are the reason for failure. Experiments show that investors who constantly receive the latest information make only half the profit that investors who do not receive the latest information make at all. This suggests that wise investors should be comfortable holding onto their stocks and not be overly affected by market fluctuations.

Defensive Investor and Enterprising Investor

Defensive investors follow the philosophy of “owning stocks”, using a portfolio strategy to buy stocks with the intention of owning and holding them for long-term gains through dividends and capital appreciation. Due to the challenges and dangers of picking individual stocks, defensive investors should prioritize portfolio diversification. Unlike the Enterprising Investor, achieving superior results compared to the defensive investor is quite a challenging endeavor. Enterprising investors, armed with the “rent a stock” philosophy, have cognitive tools that set them apart from defensive investors. In particular, enterprising investors excel in their ability to understand market prices and interpret financial statements. Their decision-making process differs from that of the media or the crowd and favors precise analysis and reasoning.

Source: Summary of “The Intelligent Investor” by Benjamin Graham

Value Investing

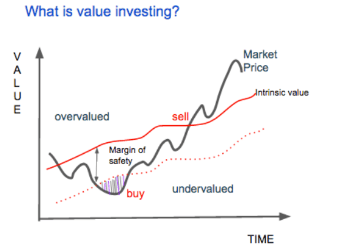

Value investing involves the calculation of a common stock’s intrinsic value, disregarding its market price. Examining a company’s assets, earnings, and dividends helps ascertain the intrinsic value, which can then be compared to the market price. If the intrinsic value exceeds the market value, meaning the stock is undervalued, investors should purchase and retain it until a mean reversion transpires. The mean reversion theory suggests that, with time, the market price and intrinsic price merge, ultimately reflecting the true value of the stock. If an investor acquires a stock at an amount below its intrinsic value, they are essentially procuring it at a discount. When said stock begins trading at its intrinsic value, it is advisable to sell it.

Source: what-does-the-intelligent-investor-teach-you

The Investor and Market Fluctuation

For the majority of the time, the market accurately prices stocks, but occasionally, the price is significantly wrong. Graham explains why by conjuring up an image of the market as being “Mr. Market;” a frantic investor who pays too much for stocks when they are doing well and desperately tries to get rid of them when their price falls. It’s, therefore, important that the intelligent investor can view the market as a fallible, emotion-driven entity that shouldn’t be blindly trusted, even though most people do.

Savvy investors should act in their best interests, avoiding being swayed by dramatic market fluctuations. According to Graham, one of the advantages of individual investing is the ability to think independently. Losing oneself in market behavior will compromise one’s most valuable asset: objective and critical thinking.

Investing is not about outperforming others in the investment game; rather, it entails managing your behavior and taking charge of your own strategies. The stock market presents the optimal option for long-term investments, and automating this meticulous approach allows you to avoid making impulsive, market-driven choices. According to Graham, it would be more favorable if we were unable to access market prices for our stocks, as it would shield us from the despair brought on by “mistakes made by others.” By utilizing autopilot mode for your portfolio, you can mitigate the impact of market fluctuations and concentrate on achieving your long-term financial objectives.

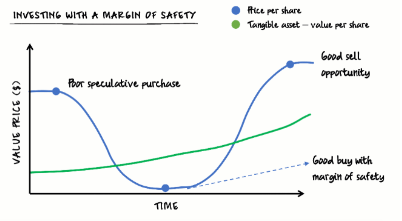

Margin of Safety

Graham also advocated for an investment approach that offers a margin of safety to minimize the impact of human error. One way to achieve this is to purchase undervalued or neglected stocks. The margin of safety helps investors navigate market volatility, unpredictable events, and irrational investor behavior. Diversifying holdings through the purchase of stocks in businesses with high dividend yields and low debt-to-equity ratios can increase investor margin of safety. This strategy aims to reduce potential losses in the event of corporate bankruptcy.

Source: Summary of “The Intelligent Investor” by Benjamin Graham

Dividend Stock

Many of Graham’s investment principles remain relevant today. Graham criticized companies for their opaque and irregular financial reporting practices, which made it difficult for investors to obtain a complete picture of a company’s health. Graham later authored a book about interpreting financial statements, such as balance sheets, revenue and expense statements, and financial ratios. Additionally, Graham advocated for businesses to pay dividends to their shareholders instead of retaining all of their profits as earnings.

The Benjamin Graham Formula

Typically, Graham purchased stocks at two-thirds of their net-net value to establish a margin of safety. Net-net value is another investment technique developed by Graham that values a company based solely on its net current assets.

The original Benjamin Graham Formula for finding the intrinsic value of a stock is as follows:

Source: Summary of “The Intelligent Investor” by Benjamin Graham